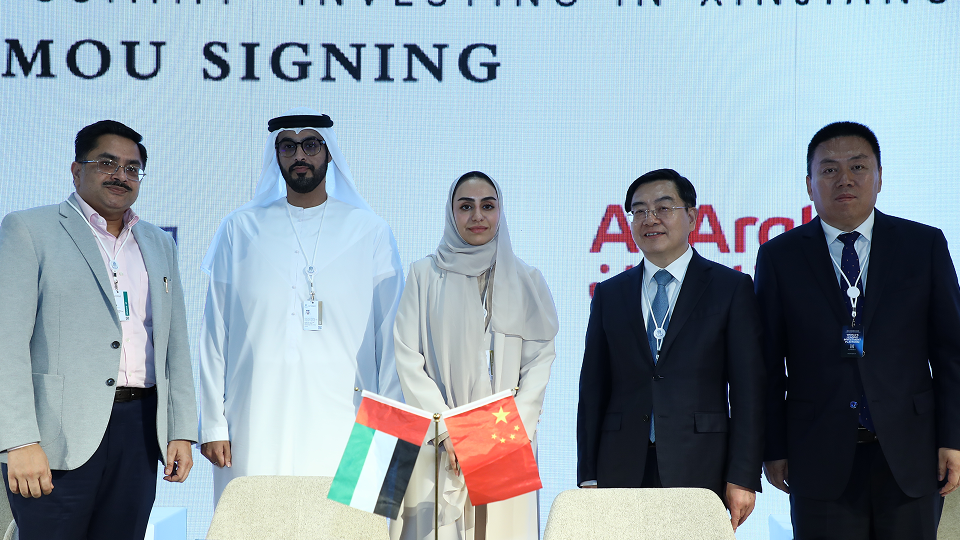

Strategic MoU Signed to Foster Collaboration and Shared Growth

A strategic MoU between a leading UAE investment entity and a Paris‑based AI and macroeconomic intelligence firm has given rise to a new joint venture in Abu Dhabi. The collaboration aims to deliver cutting-edge AI-powered nowcasting, alternative data analytics, and real-time macroeconomic intelligence to institutions across the Middle East. Designed for institutional investors, corporates, financial institutions, and government agencies, the platform enables strategic planning, forecasting, and dynamic tracking of global supply chains, trade flows, and asset movements. Leveraging regionally tailored insights alongside global data lakes, the joint venture meets the UAE’s national priorities in artificial intelligence, data‑driven decision‑making, and economic innovation.

This initiative builds on prior strategic investments and reflects a commitment to expanding access to AI-driven economic analytics, enhancing operational readiness, and supporting growth across emerging MENA markets.

Quant Cube

QuantCube Technology is a Paris-based fintech company specializing in real-time macroeconomic intelligence. Founded in 2013, it leverages artificial intelligence and big data analytics to process billions of alternative data points, providing predictive insights into economic indicators such as growth, inflation, and labor markets. QuantCube's solutions serve financial institutions, governments, and corporations, enabling data-driven decision-making and strategic planning. The company's innovative approach combines satellite imagery, social media sentiment, and geolocation data to deliver accurate forecasts ahead of traditional economic reports. With a diverse team of data scientists and economists, QuantCube is at the forefront of economic nowcasting.

The Strategic Development Fund

The Strategic Development Fund (SDF) is a state-sponsored investment vehicle focused on catalyzing transformative economic projects aligned with national priorities. By backing ventures in sectors like technology, infrastructure, healthcare, and sustainability, the SDF aims to accelerate development impact, attract foreign capital, and support public-private collaboration. With flexible financing structures—ranging from direct equity to co-investment and strategic partnerships—it empowers innovation ecosystems, nurtures long-term growth, and enhances regional competitiveness while aligning financer and societal objectives.